Last Updated: 01.20.2025

INTRODUCTION

Welcome to hotapprove.com (“we,” “us,” “our,” or “Site”). By using this Site and Service, you agree to be bound by these Terms of Service (“Terms”). If you disagree with any part of these Terms, please don't use our Site or Service.

These Terms are a binding agreement between you and us. They explain your rights and responsibilities when you use our Site and Service, along with key disclaimers and limitations of liability.

MODIFICATION OF TERMS

We can change these Terms, including any related Disclosures and policies, at any time. We will notify you of any changes by posting the revised document on the Site, or by other reasonable means. If you continue to use the Site or our Service after we make changes, you accept the updated Terms. Check the "Last Updated" date at the top of each document to see when the Terms were last changed.

PLEASE READ THIS SECTION CAREFULLY

THESE TERMS CONTAIN A BINDING ARBITRATION AGREEMENT AND A CLASS ACTION WAIVER. THESE PROVISIONS REQUIRE YOU TO ARBITRATE ANY DISPUTES OR CLAIMS YOU HAVE WITH US ON AN INDIVIDUAL BASIS. YOU WILL NOT BE ABLE TO PARTICIPATE IN A CLASS ACTION OR MULTI-ARBITRATION. YOU HAVE THE RIGHT TO OPT OUT OF THIS REQUIREMENT.

ELIGIBILITY

Our Service is only for U.S. residents of legal age. By accessing this Site and using our Service, you confirm that:

- You are at least 18 years old, reside in the U.S. and possess the legal capacity to enter into this Agreement.

- You are acting on your own behalf.

- You agree to use our Service solely for personal, non-commercial purposes.

OUR SERVICE DESCRIPTION

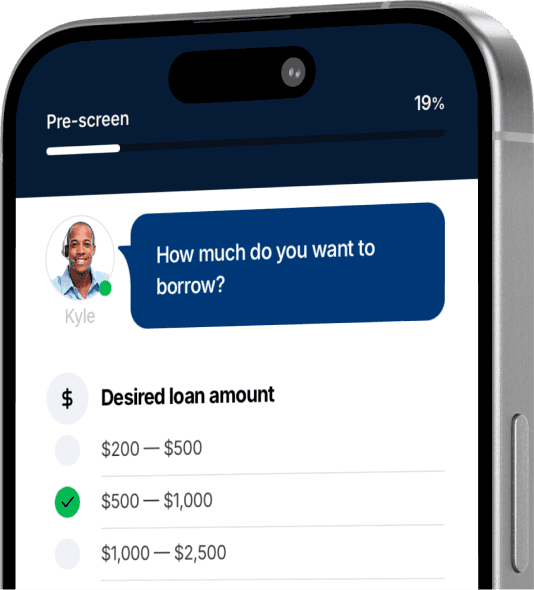

Our platform facilitates connections between users seeking loans ("Users") and potential lenders, lender networks (“Lending Partners”) or third-party financial service providers (“Service Providers”). Our platform offers an online application process where Users can submit their personal and financial information to be considered for loan offers (“Service”).

Compensation and Transparency. Our Service is free of charge to you. However, we receive financial compensation from Lending Partners, Service Providers, and other marketers in exchange for connecting you with them, sharing your information with them, and/or marketing their products and services to you.

This compensation allows us to offer our Services at no cost to you and supports our business operations. Please note that the compensation we receive may influence which lenders or services you are connected with, and the visibility of ads.

You are more likely to be connected with the highest bidder(s) or see ads for those who offer the highest compensation.

For more details on how we share your information with Lending Partners, Service Providers, and marketers, and the compensation we receive, please review our Marketing Practices Disclosure.

We also explain the personal information we collect, how we use it, and your rights in our Privacy Policy.

By using Service, you confirm that you have read, understood, and agreed to our Marketing Practices Disclosure and Privacy Policy and acknowledge that they are fair and reasonable.

HOW SERVICE WORKS

To use our Service, you must complete a questionnaire about certain personal and financial details on our Site (“Request Form”). You agree to provide only true, accurate, and complete information and that you will not misrepresent your identity, impersonate any third party, or enter information on behalf of any third party. We are not responsible for verifying the accuracy of the information you provide.

Once you submit your request form(s), we will share your information with one or more Lending Partners.

Lending Partners may review your information to assess whether to respond to your Loan Request by inviting you to apply for a Loan – or to help find a lender willing to accept your Loan Request. This may include verifying your information, performing a credit check. By submitting a Loan Request Form, you authorize Lending Partners to obtain, review, and verify your information, potentially including a credit check, to determine whether to respond to your Loan Request.

If a lender expresses interest in your request, we will connect you with such a lender by either opening a new web page or redirecting you to the lender’s site. At this point our involvement in the loan request ends and your interactions with the lender are governed solely by agreements, terms, policies by such lender and it is your responsibility to review them before entering into any agreement with them.

If no lenders are found for your request, we may present you with marketing for personal finance related products and services (“Financial Services”) offered by third-party service providers (“Service Providers”). Yоu are under no obligation to accept or respond to any loan offers or Financial Services solicitations.

SERVICE DISCLAIMER

Not a Lender:

- We are not a lender, creditor, financial institution, nor are we a representative, broker, or agent of any such entity.

- We do not make credit prequalifications, decisions, or provide loans.

- We neither offer nor solicit to lend.

- Our Site operates as an independent platform, with the primary purpose of connecting you to lenders who may offer loans.

Important Note:

- Lenders participating in our program offer loans ranging from $200 to $5,000, but not all lenders offer the maximum amount.

- We cannot guarantee that any lender will offer you a loan or approve your request. Loan approval depends on the lender's criteria, including your credit score, income, and other financial information.

- We do not make any representations or guarantees about the terms of loans offered by lenders, you may connect with through our Site, including the likelihood of obtaining the best loan terms, certain interest rate or any specific conditions. Rates and terms vary by lender and are outside of our control.

- We do not validate or investigate the licensing, certification or other requirements and qualifications of any lenders. You acknowledge that it is your responsibility to investigate any lender or financial provider before engaging with them.

Service availability:

- Our service is not available in all states.

- Not all lenders within our network operate in all US states. Residents of some US states may not be eligible for loan products in accordance with specific legislation of their state.

- By selecting your state you shall be informed of any limitations regarding obtaining a loan if you reside in individual US states.

You are responsible for your decisions.

Remember that your financial decisions are your responsibility. While we offer a platform for finding you a loan option, we don't take responsibility for the choices or actions you make based on the information we provide.

Key Points to Consider:

- Carefully examine all terms and conditions of any loan or financial service offer.

- Compare multiple options before making a decision.

- Review our Responsible Lending and Rates and Fees disclosures for general guidance.

- Consult qualified financial advisors or professionals for personalized advice tailored to your situation.

The information we provide is intended for general knowledge and isn't a replacement for professional financial advice. We don't take responsibility for any losses, costs, damages, or claims that may result from your use of any lender's or financial provider's services, including any fees they charge. You agree that you're relying on your own judgment and any advice you receive when choosing financial products or services.

YOUR CREDIT REPORT CHECK

To assess your eligibility for a loan, lenders may review your credit report from one or more credit reporting agencies (such as TransUnion, Experian, or Equifax).

Additionally, to offer relevant financial services like debt relief programs, credit monitoring, or credit repair, we or our Service Providers may need to access certain details from your credit report, such as your credit score or total debt amount.

Before you submit your inquiry, we will request your authorization to allow us, our Lending Partners, and Service Providers to access and use your credit information as outlined in our Credit Authorization terms.

ELECTRONIC CONSENT (“E-CONSENT”)

We and our Lending Partners require your consent to conduct transactions electronically, including using electronic signatures and receiving electronic communications, to facilitate your online loan request and enable the provision of an online loan.

By providing your information and submitting a request to be connected with Lenders via our Service you consent to conduct transactions and sign electronic contract documents, including this Agreement, using electronic signatures, as well as receive disclosures, records and other communications electronically in accordance with our E-Consent Terms and Conditions.

You agree that all agreements, notices, disclosures and other communications that we or Lenders provide to you electronically satisfy any legal requirement that such communications be in writing.

CONSENT FOR COMMUNICATIONS

By providing your information and requesting our services, you establish a business relationship with us. This allows us to contact you about our Service for up to 180 days from your last information input or service request, without needing additional consent.

Nevertheless, we may also ask for your consent to receive marketing communications via email, text messages, and phone calls from us, our Lending Partners and Service Providers.

Opt-Out

You have the right to withdraw your consent to receive marketing communications at any time, without impacting your ability to connect with a lender or obtain a loan or other advertised services. To stop receiving marketing communications, simply click the unsubscribe link or follow the instructions provided in the marketing communications.

PROHIBITED USES

You acknowledge and agree to avoid the following activities, which are expressly prohibited, by using our Site and Services:

- Providing false or misleading information, including impersonating another individual or falsely claiming employment with an organization.

- Submitting loan applications on behalf of another individual.

- Attempting to circumvent security measures, including unauthorized access to accounts, testing system vulnerabilities, or breaching security protocols to access restricted information.

- Copying or stealing proprietary materials, including designs, media, graphics, code, and products, with the exception of permitted documents such as this Agreement, Privacy Policy, or other related documentation.

- Utilizing computer programs to collect information from our site, including email addresses or phone numbers for use on our site or other platforms.

- Interfering with site functionality or disrupting other users, including accessing unauthorized information, transmitting viruses, overloading the system, sending spam, or engaging in other disruptive behaviors.

- Utilizing our Site or Services for unsolicited email communications, including promotional emails or advertisements.

- Tampering with email headers or other transmitted information via our Site or Services.

- Attempting to modify, reverse-engineer, decompile, disassemble, or decipher any source code used in the Site or Services.

Engaging in any of these activities may result in suspension of Site and Service access, account termination, and potential legal action.

THIRD-PARTY WEBSITES

Our platform may contain links to external websites, including those of Lending Partners and Service Providers. Your use of any external websites linked from our platform is entirely at your own risk. We do not endorse, control, monitor, or assume any responsibility for the content, practices, or services offered by these third-party websites, including but not limited to those of our Lending Partners and Service Providers. We make no representations or warranties regarding the accuracy, completeness, reliability, legality, or safety of any information, content, or services provided on these external sites.

You are solely responsible for evaluating and verifying the credibility, legitimacy, and suitability of any third-party websites and their offerings before engaging with them. We shall not be liable for any damages, losses, or consequences arising from your use of, or reliance on, any external websites or their content.

Furthermore, please be aware that these third-party websites have their own terms of use, privacy policies, and fee structures. We encourage you to carefully review these policies before using their services. By accessing and using any external websites, you agree to comply with their respective terms and conditions and release us from any liability associated with your interactions with them.

INTELLECTUAL PROPERTY

All content on this Site, including text, images, graphics, logos, and software, is solely owned by us and/or our licensors. Your use of the Site does not grant you ownership rights or licenses to any content, trademarks, or other intellectual property displayed on the Site. We grant you a non-exclusive, limited right to use the Site solely for the purpose of accessing the Services and exercising the rights provided to you under this Agreement.

DISCLAIMER OF WARRANTIES

YOU EXPRESSLY AGREE THAT YOUR USE OF THE SITE AND ANY SERVICES ON THE SITE IS AT YOUR OWN RISK. WE PROVIDE THE SITE AND THE SITE SERVICES ON AN "AS IS" BASIS.

WE EXPRESSLY DISCLAIM ALL WARRANTIES OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING THE IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, TITLE, AND NON-INFRINGEMENT.

WE MAKE NO WARRANTY THAT THE SITE OR OUR SERVICES WILL MEET YOUR REQUIREMENTS, OR THAT THEY WILL BE UNINTERRUPTED, TIMELY, SECURE, OR ERROR FREE.

WE MAKE NO WARRANTY AS TO THE RESULTS THAT MAY BE OBTAINED FROM THE USE OF THE SITE, OUR SERVICES OR ANY PRODUCTS OR SERVICES YOU FIND THROUGH OUR SERVICES.

WE MAKE NO WARRANTY AS TO CONFIDENTIALITY OR PRIVACY OF ANY OF USER’S INFORMATION, EXCEPT AS SET FORTH IN OUR PRIVACY POLICY OR REQUIRED BY APPLICABLE LAW.

NO ADVICE OR INFORMATION, WHETHER ORAL OR WRITTEN, OBTAINED BY YOU FROM US ON THE SITE OR ITS SERVICES SHALL CREATE ANY WARRANTY NOT EXPRESSLY MADE HEREIN.

WITHOUT LIMITING THE FOREGOING, YOU ACKNOWLEDGE AND AGREE THAT WE ARE NOT A CREDITOR, BROKER, FINANCIAL SERVICE PROVIDER, OR OTHER SIMILAR SERVICE PROVIDER. YOU ACKNOWLEDGE AND AGREE THAT WE ARE SOLELY AN INTERMEDIARY BETWEEN YOU AND SUCH PROVIDERS AND, THEREFORE, WE EXPRESSLY DISCLAIM ANY AND ALL LIABILITY FOR ANY CONTENT, PRODUCTS OR SERVICES PROVIDED BY SUCH PROVIDERS.

SOME JURISDICTIONS DO NOT ALLOW THE EXCLUSION OF CERTAIN WARRANTIES, SO SOME OF THE ABOVE EXCLUSIONS MAY NOT APPLY TO YOU.

LIMITATION OF LIABILITY

IN NO EVENT SHALL WE BE LIABLE FOR SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES, LOST PROFITS, LOST DATA OR CONFIDENTIAL INFORMATION, LOSS OF PRIVACY, COSTS OF PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES, FAILURE TO MEET ANY DUTY OF GOOD FAITH OR REASONABLE CARE, NEGLIGENCE, OR OTHERWISE, REGARDLESS OF THE FORESEEABILITY OF THOSE DAMAGES OR NOTICE GIVEN TO US, ARISING OUT OF OR IN CONNECTION WITH YOUR USE OF THE SITE OR SERVICES.

This includes, but is not limited to, any disputes, decisions, agreements, or outcomes arising from your interactions or relationships with any lender or third party connected to you through our Site or Services. We are not responsible for loan approvals, terms, repayment obligations, or any other action or inaction by a lender.

OUR MAXIMUM LIABILITY TO YOU UNDER ALL CIRCUMSTANCES SHALL NOT EXCEED $100.00. YOU AGREE THAT THIS LIMITATION REPRESENTS A REASONABLE ALLOCATION OF RISK AND IS A FUNDAMENTAL ELEMENT OF THE BASIS OF OUR AGREEMENT.

Some jurisdictions do not allow limitations on implied warranties or the exclusion of certain damages. If these laws apply to you, some or all of the above limitations may not apply.

INDEMNIFICATION

Without limiting any other indemnification provisions in this Agreement, you agree to defend, indemnify, and hold us harmless (along with our officers, directors, employees, agents, affiliates, representatives, sub-licensees, successors, and assigns—collectively, the “Indemnified Parties”) from and against any and all claims, actions, demands, causes of action, liabilities, damages, costs, or expenses (including legal costs and attorneys’ fees) arising out of or relating to: (a) your breach of this Agreement, including any warranties or representations made herein; (b) Your use of the Site or Services in violation of this Agreement; (c) Disputes, claims, or liabilities resulting from your interactions with any lender, Lending Partner, or third party, including, but not limited to, issues with loan offers, terms, or payments; (d) Your violation or alleged violation of any federal, state, or local laws or regulations (e) Any claim alleging that content or data you provide infringes a third party’s intellectual property rights.

The Indemnified Parties reserve the right to participate in any defense you provide, at their own expense, but are not obligated to do so. You may not settle any claim without the prior written consent of the relevant Indemnified Parties.

GOVERNING LAW

The site, Services, and this Agreement, including without limitation this Agreement's interpretation, shall be treated as though this Agreement were executed and performed in Las Vegas, Nevada and shall be governed by and construed in accordance with the substantive laws of the State of Nevada without regard to its conflict of law principles. ANY CAUSE OF ACTION OR CLAIM BY YOU ARISING OUT OF OR RELATING TO THE SITE, SERVICES OR THIS AGREEMENT MUST BE INSTITUTED WITHIN ONE (1) YEAR AFTER THE CLAIM OR CAUSE OF ACTION AROSE OR BE FOREVER WAIVED AND BARRED. ALL ACTIONS SHALL BE SUBJECT TO THE LIMITATIONS SET FORTH ABOVE. The language in this Agreement shall be interpreted in accordance with its fair meaning and not strictly for or against either party.

MANDATORY AGREEMENT TO ARBITRATE ON AN INDIVIDUAL BASIS ("ARBITRATION AGREEMENT")

PLEASE READ THIS SECTION CAREFULLY – THIS ARBITRATION AGREEMENT MAY SIGNIFICANTLY AFFECT YOUR LEGAL RIGHTS, INCLUDING YOUR RIGHT TO FILE A LAWSUIT IN COURT AND TO HAVE A JURY HEAR YOUR CLAIMS. IT CONTAINS PROCEDURES FOR FINAL BINDING ARBITRATION AND A WAIVER OF ANY AND ALL RIGHTS TO PROCEED IN A CLASS, COLLECTIVE, CONSOLIDATED, OR REPRESENTATIVE ACTION (HEREINAFTER "CLASS ACTION"). ARBITRATION REPLACES THE RIGHT TO GO TO COURT. YOU ARE GIVING UP THE RIGHT TO HAVE A JURY TRIAL TO THE FULLEST EXTENT PERMISSIBLE BY LAW, OR TO FILE OR PARTICIPATE IN A CLASS OR REPRESENTATIVE ACTION SUBJECT TO THE LIMITED EXCLUSIONS BELOW.

You and we each agree to resolve any and all disputes or claims that have arisen or may arise between you and us (including any affiliates, officers, directors, employees, and agents), whether or not such dispute or claim involves a third party, relating in any way to any aspect of our relationship or any contact between us, direct or indirect, or arising out of this or previous versions of these Terms, your use of or access to our Site or services, or any products or services sold, offered, or purchased through our Site or services (“Dispute”) through negotiations and in good faith. If we don’t resolve the Dispute within 60 days you and we each agree to resolve it exclusively through final and binding arbitration.

You and we agree as follows:

(a) To submit the Dispute to a single arbitrator under the then-current Commercial Arbitration Rules of the American Arbitration Association (AAA), including when applicable the Optional Rules for Emergency Measures of Protection and the Consumer Arbitration Rules, or, by separate mutual agreement, at another arbitration institution. The AAA’s rules, information regarding initiating a claim, and a description of the arbitration process are available at www.adr.org. The location of the arbitration and the allocation of fees and costs for such arbitration shall be determined in accordance with the AAA rules. As an alternative, you or we may bring a claim in your local “small claims” court, if permitted by that small claims court’s rules.

(b) The Federal Arbitration Act governs the interpretation and enforcement of this Agreement to Arbitrate, and the arbitrability of the Dispute. The arbitrator will decide whether the Dispute can be arbitrated.

(c) You and we agree that each of us may bring a Dispute against the other only on our own behalf, and not on behalf of a government official or other person or entity, or a class of persons or entities. You and we agree, if we are a party to the proceeding, not to participate in a class action, a class-wide arbitration, a claim brought in a private attorney general or representative capacity, or a consolidated claim involving another person’s use of the Site or our services. You and we agree not to combine a claim that is subject to arbitration under these Terms with a claim that is not eligible for arbitration under these Terms. You and we agree to waive the right to a trial by jury for all disputes.

(d) If the prohibition against class actions and other claims brought on behalf of third parties is found to be unenforceable, then this prohibition will be null and void as to that Dispute.

(e) This Agreement to Arbitrate will survive the termination of your relationship with us.

To the extent permitted under applicable law, all aspects of the arbitration proceeding, and any ruling, decision, or award by the arbitrator, will be strictly confidential for the benefit of all parties.

Unless you and we agree otherwise, if the Agreement to Arbitrate is found by a court to be unenforceable, if your claim is not covered by the Agreement to Arbitrate, or if you neither are a resident of nor have a principal place of business in the US, you agree that any Dispute that has arisen, or may arise, between you and us must be resolved exclusively by a state or federal court located in Clark County, Nevada. You and we agree to submit to personal jurisdiction in such a court.

Notwithstanding any provision in these Terms to the contrary, you and we agree that if we make a change to this Agreement to Arbitrate (other than a change to the notice address or the Site link provided herein) in the future, that change shall not apply to a claim that was filed in a legal proceeding between you and us prior to the effective date of the change. The change shall apply to all other disputes or claims governed by the Agreement to Arbitrate that have arisen, or may arise, between you and us. We will notify you of a change to this Agreement to Arbitrate by posting the amended terms on the Site.

You may opt out of this Agreement to Arbitrate. If you do so, neither you nor we can require the other to participate in an arbitration proceeding. To opt out, you must notify us in writing within 30 days of the date that you first became subject to this arbitration provision. Notice must be provided by email to contact@hotapprove.com with the subject line “Arbitration Opt-Out.”

MISCELLANEOUS

This Agreement together with all Disclosures, E-Consent and Credit Authorization and any consent, acknowledgement, confirmation, authorization given on our Site constitutes the entire agreement between you and us concerning your use of the Site and Services.

If any part of this Agreement is held invalid or unenforceable, that part will be construed to reflect the parties' original intent, and the remaining portions will remain in full force and effect. A waiver by either party of any term or condition of this Agreement or any breach thereof, in any one instance, will not waive such term or condition or any subsequent breach thereof. This Agreement and all of your rights and obligations hereunder will not be assignable or transferable by you without our prior written consent. This Agreement will be binding upon and will inure to the benefit of the parties, their successors and permitted assigns. You and we are independent contractors, and no agency, partnership, joint venture or employee-employer relationship is intended or created by this Agreement. Except as and to the extent set forth herein, there are no third-party beneficiaries to this Agreement. The headings in this Agreement are for the purpose of convenience only and shall not limit, enlarge, or affect any of the covenants, terms, conditions or provisions of this Agreement.

CONTACT US

Any questions, requests, notices must be sent via email at contact@hotapprove.com.

Approve Rate up to 95%

Approve Rate up to 95%